Risk is the effect of uncertainty on objectives. Climate change, along with its broader environmental, social and governance (ESG) impact, is one of the greatest uncertainties the whole of humanity has faced together.

The risk framework is big and complex and much of what could transpire is alarming. That said, there is also opportunity to be found.

This month’s featured risk focuses on that topic. While it pervades all aspects of our lives, the release of the Central Bank’s survey means it has moved to the top of the agenda in our boardrooms.

The Central Bank of Ireland Survey

In December 2022, the Central Bank of Ireland (CBI) issued a survey on climate-related and environmental risks to all credit unions it regulates. The objective of the survey is to assess the level of awareness of climate-related risks, potential exposures, and any actions credit unions may be taking to mitigate already identified risks.

What can your credit union do now to demonstrate the effective management of climate-related risk?

- Scenario Analysis

Conducting scenario analysis will allow your credit union to demonstrate that it has a sound understanding of the potential climate risk exposures in its loan book, to its membership, and more. For instance, credit unions could conduct a scenario analysis / stress test to determine if its loan book contains a high concentration of agricultural loans. But remember, not all scenarios need to be negative – there are also potential upsides… members taking out ‘green loans’ to buy hybrid / electric cars, for example.

- KPIs / Strategy

Build climate-related issues into your existing KPI tracking and strategic planning processes. One example would be, when reviewing your strategic plan, to consider the potential upside in your membership becoming more climate-conscious.

- Risk Management

Build climate-related risks into your existing risk management framework. Where suitable, add climate-related KRIs to your risk appetite framework; include climate-related risks in your risk register; consider climate implications when outsourcing; etc.

- Investments

Consider climate issues when making investment decisions, and perhaps update your Investment Policy to reflect this too.

Build it in, don’t bolt it on! Credit unions already have a lot of these processes in place – the trick is to build your climate-related risk assessments and ongoing monitoring into these processes, turning them into ‘business as usual’, rather than starting from scratch!

The Featured Risk

The featured risk, Failure to appropriately address climate risk and broader ESG issues, presents CalQRisk users with a series of questions to test the measures they have in place for addressing climate change, while also proposing controls to mitigate the risk. In addition, the risk looks to confirm that there are effective policies and procedures in place, that these are clearly communicated to the relevant people, that they are appropriately implemented, and that they work.

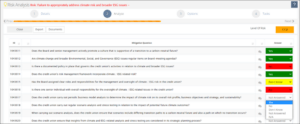

Fig. 1 – Screenshot of a sample of questions from CalQRisk

The questions and controls presented to the user are drawn from the CalQRisk knowledgebase which is informed by current best practice. Each question tests the effectiveness of a control that will, when in place, reduce the likelihood and / or the consequence of a failure to appropriately address climate risk and broader ESG issues.

Where the user feels that a control may be lacking or simply not strong enough, answering ‘No’ to the control question posed will allow them to set up and assign a task to rectify it using CalQRisk’s integrated Action Manager.

In addition, there are a number of exportable reports available that are automatically derived from the user’s answers to the control questions – including risk registers, compliance reports and many more.

For more information on how CalQRisk can assist in streamlining your Governance, Risk Management and Compliance processes, get in touch here