The Central Bank of Ireland recently published its Regulatory & Supervisory Outlook Report 2025 (RSOR 2025) and the continuing evolution of its approach to supervision towards a more outcomes-based and consumer-focused approach is clear and laudable. Over the years, the traditional directive approach to regulation has been to rely heavily on compliance with very prescriptive legislation and regulation to produce specific desired behaviours. But this approach had its limits.

This continuing supervisory evolution process is particularly significant when you consider how, in risk management theory, directive controls, whilst vital to set boundaries and expectations, particularly from the perspective of good governance, are the least effective type of control in terms of achieving desired outcomes. There is a material difference between following the letter of the law just to be compliant with legislation or regulation and proactive risk management, which means doing the right things for the right reasons, resulting in better outcomes for consumers of financial services while maintaining compliance. RSOR 2025 trains its first spotlight on Safeguarding Consumer Interests.

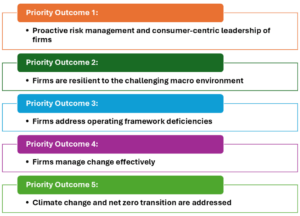

Similar to the 2024 report, in RSOR 2025, the CBI lists their key supervisory priority outcomes for its regulated firms as follows (there is a 6th but that’s for CBI itself):

Having again listed ‘proactive risk management and consumer-centric leadership of firms’ as number 1 in its list of priority outcomes and drawn attention to it in a spotlight article, it is clear that the CBI is looking for regulated entities to adopt a more consumer-focused approach. It is important for credit unions to be able to demonstrate how they are embedding this in their decision-making processes. And it is equally important to demonstrate that credit unions are monitoring for poor outcomes and adjusting their approach where appropriate.

Fortunately, credit unions already excel at being consumer-centric. As volunteer-led, professionally run co-operatives, credit unions continue to put the needs of their members first. The fact that credit unions have again been recognised as Number 1 in Ireland’s Reputation Index as published by the Reputations Agency in April 2025 proves that this consumer-focused approach works for all stakeholders!

RSOR 2025 also provides an overview of risk themes and risk areas across the financial services sector, placing it firmly in the context of the global macro environment this year. In this current period of geopolitical uncertainty, RSOR 2025 puts another spotlight on this issue in the report. Credit unions are seeing the repercussions of the global macro environment playing out at local level. CalQRisk’s Credit Union Risk Advisory Service subscribers recently received an e-zine on ‘Credit Risk in Uncertain Times’ which focusses on practical risk management considerations for credit union lending at the present time.

The sectoral analysis section of RSOR 2025 (on pages 75 to 80) addresses CBI’s view of the key risks pertaining to the credit union sector:

- Business model and strategic risks

- Financial risks and resilience

- Culture, governance and risk management

- Operational risks and resilience including cyber-related

This week, CalQRisk’s Risk Advisory Service also provided subscribers with a detailed guide on reviewing their credit union risk management frameworks in the context of RSOR 2025. The guide includes recommendations on next steps to help risk management professionals continue to demonstrate strong risk management embeddedness in their own credit unions in this context.

If you would like to know more about CalQRisk’s Credit Union Risk Advisory Service, please contact us at riskadvisory@calqrisk.com