Core Foundations

Demonstrate resilience at the click of a button

Streamline everything from process mapping to third party due diligence.

This is the ops resilience version

Trusted by hundreds of clients globally

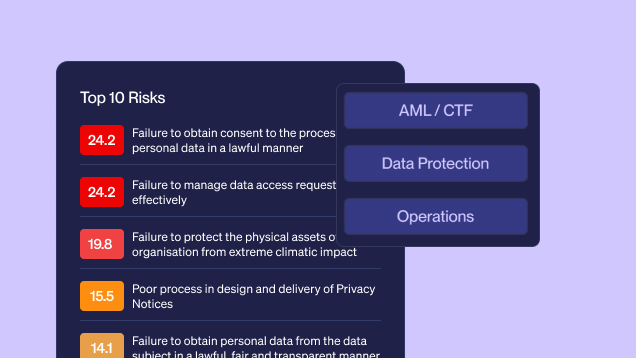

Strengthen operational resilience

Build, maintain and automate a robust operational resilience programme.

Track tasks and accountability

Assign and track remediation actions across your team ensuring nothing slips through the cracks.

Report at the click of a button

Generate tailored reports on risks, controls and more with a single click.

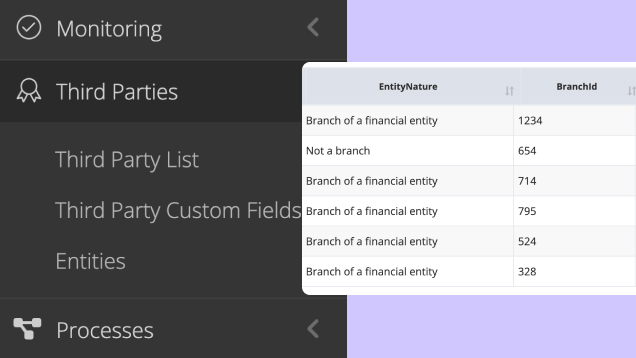

Keep tabs on third-party risk

One platform to power every step of your vendor lifecycle - from initial due diligence to offboarding.

Unite your teams on one platform

Unite all stakeholders on one platform with shared data and reporting, eliminating information silos fast.

Roles

Related roles that benefit from our platform.

Enable risk, IT, finance, and board-level stakeholders to build and maintain resilience across critical business services.

Next Steps

Ready to elevate your Operational Resilience?

Schedule a 30-minute platform walk-through with our expert team.